Using the Bill Payment Checklist form we’ve created here at Cents and Order is simple. But the right bill paying system could’ve helped me get the bill paid on time even though I hadn’t received the actual statement in the mail.Įven if you are great about paying the bills when they come in, what happens if you don’t get the bill? Using a Bill Payment Checklist will remind of you of all your bills – even if the bill gets lost.

#BILLS TO PAY LIST PLUS#

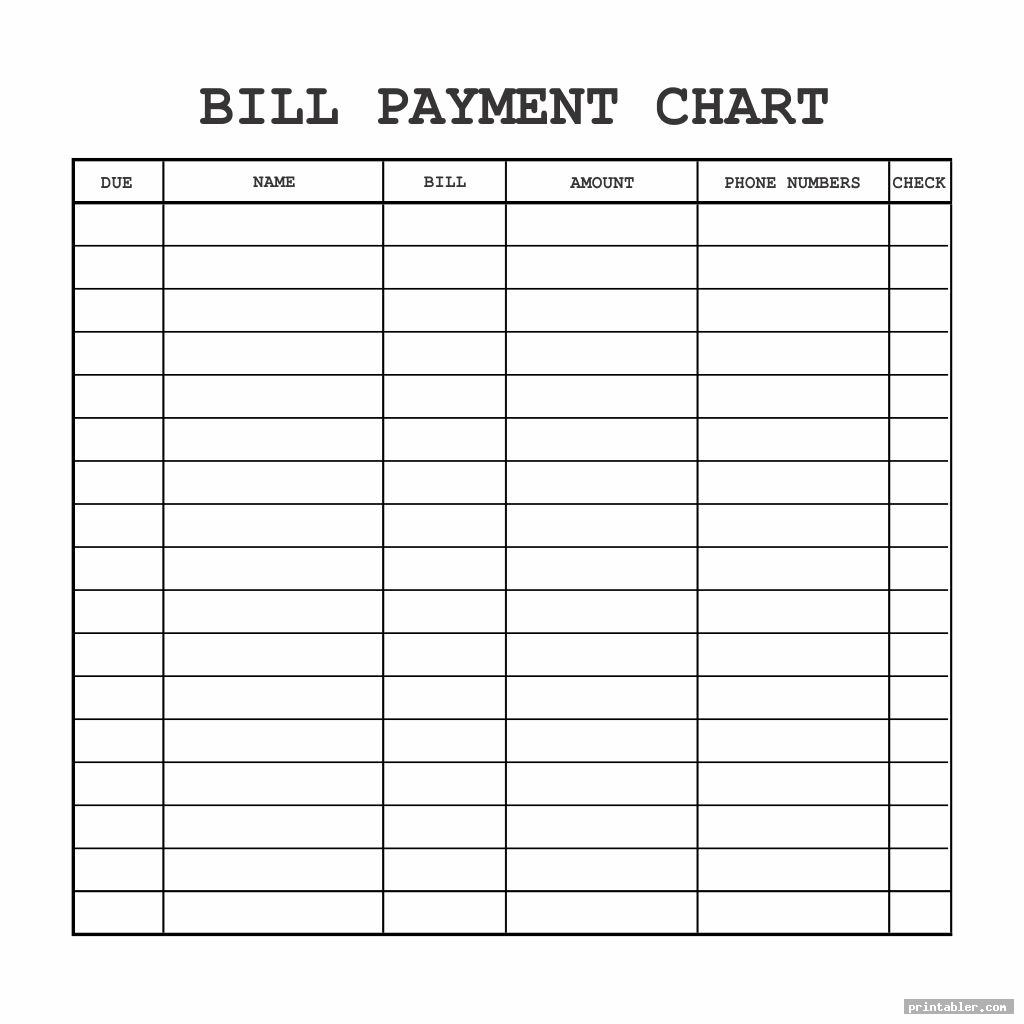

So I went back through my files plus the papers on my desk looking to find the bill. It had been a busy couple of weeks in our household and I figured that with all the chaos, I just missed the bill. In my case the missed payment was simply a lack of being organized. There’s something about getting calls from creditors that can be a little intimidating. But imagine if a lack of a bill paying system resulted in you getting reminder calls from creditors on a regular basis. For me, that’s a big deal – I am pretty meticulous with my finances. The second reason is that when you don’t pay your bills on time, you can be setting yourself up for trouble.Īs an example, one day, I received a phone call that one of my bills was late. The first is that using a system that works for you will make life less stressful. Using some type of system to keep track of and to pay your bills is important for a couple of reasons. It will also provide you a quick overview of what bills you have upcoming and a way to track your payments. The Bill Payment Checklist form is simple go-to form that will list all of your bills and give you a way to remember what needs to be paid – and when.

I like to keep track of my bills on a little form called a Bill Payment Checklist. Knowing what bills you have and when they’re due will give you the main information you have to have in order to create a budget. Even if you don’t have a budget created yet, this is the beginning to getting your finances organized. But never fear: we’ll start with a much smaller task so you can be on your way to better budgeting!īefore you even begin to think about budgeting, you need to know what bills you have each month and when they are due. You may have seen those pretty financial/budget binders on Pinterest and thought it takes way too much time to be that organized. For some people, organization comes naturally but for others, not so much. If online payment must be reversed because of insufficient funds, the Town of Boylston will charge the statutory penalty of $25.00, or one percent (1%) of the check amount, whichever is greater.One of the best ways to keep your finances in check is to be organized. mail so that you can reissue the payment. If this happens we will notify you by e-mail and also by U.S. In this situation, we must also reverse the payment, leaving your bill unpaid. Occasionally, we are notified that a transaction has been reversed because of invalid account information. The confirmation that you receive from UniBank verifies that the bank has received your payment information. See the Fee Schedule.įor your protection, neither the Town of Boylston nor UniBank stores payment information. You may also pay using your MasterCard, Discover, or American Express, but there is a fee for this service charged by the credit card companies. DO NOT USE your debit card, or you will be charged a fee. Please follow the directions on the payment site and make sure you are entering the correct numbers from your checkbook. There is a small charge for a payment made by electronic transfer from your checking account. Have your bill in front of you, because you will need to enter the bill number.

0 kommentar(er)

0 kommentar(er)